Summer a Bummer for Some (i.e. some people with MS, diabetes, and other health issues)

7/19/2015

I love summer. 80 degrees is my favorite temperature. I love to read in the heat with a glass of iced tea by my side. If I had to give up three seasons, I’d hang onto summer.

But for many seniors and people with health conditions, summer can be a bummer. Heat can provoke physical vulnerabilities to become annoying, debilitating, or even life threatening.

In this blog, I am going to address the effects of summer heat on some people, including seniors and those with certain health conditions. Please refer to the links for more in depth information.

1. Seniors

Older adults are more prone to heat stroke than younger people. Heat stroke is the most serious heat-related illness and can lead to permanent disability or death. Seniors can also be impaired by heat exhaustion if they do not take precautions. Read this excellent article by the CDC on how to prevent and treat heat stress and heat exhaustion in persons over age 65.

2. People with Multiple Sclerosis

Heat is such a common aggravator of of MS symptoms that, for many years, the “hot bath” test was used to diagnose MS. If the person put in the hot tub of water experienced blurred vision (Uthoff’s sign) or other neurological symptoms, they were assumed to have multiple sclerosis.

While heat can cause “pseudoexacerbations” of MS symptoms, summer temperatures do not cause permanent inflammation, demyelination, or lesions. If persons with MS take precautions during the summer, and cool off quickly after becoming overheated, they can keep their symptoms at bay.

3. People with Diabetes

60-70% of persons with type 1 and type 2 diabetes have difficulty adjusting to rises in temperature, leaving them susceptible to dangerously high body temperatures. The medications taken by diabetic people also can affect their ability to adapt to extreme heat. Not only can summer heat affect the health of the person with diabetes, but it can also affect insulin, pump adhesion, and test strips.

4. People with Asthma or COPD

Fluctuations in outdoor temperature can prompt asthma attacks in some individuals. Extreme heat waves have been linked to a spike in deaths for persons with lung related illnesses such as COPD. Keeping as cool as possible, having your inhaler at hand, and avoiding fragrances are some precautions that persons with asthma, COPD, or other lung diseases can take during summer months.

5. People Taking Certain Medications

6. Overweight Persons

Fatal heatstroke occurs 3.5 times more frequently in overweight or obese persons than those of average body weight. Here are some precautions to take so that persons with excess body weight are not overcome by high body temperature.

7. People with Cardiovascular Disease

There are a number of reasons why people with cardiovascular disease may not tolerate summer heat as well as others. If they have had heart attacks, their hearts may not be able to pump enough blood to get rid of the heat. Narrowed vessels can limit blood flow to their skin. Beta blockers, diuretics, and other medications can weaken their bodies’ defenses against extreme temperatures. When heart failure is present, high temperatures may be especially dangerous.

8. People with Lupus

The Lupus Foundation of America states that 75 percent of patients with systemic lupus and 90 percent of discoid lupus patients will suffer flare-ups of symptoms from even brief exposures to sun or heat. These flare-ups can last a long time and even lead to serious complications such as kidney failure or skin cancer. Therefore, it is very important for people with lupus to avoid excess sunshine and heat.

While this list is not comprehensive, I hope it prompts those of you with risk factors to take extra precautions during the summer. Your health is worth protecting!

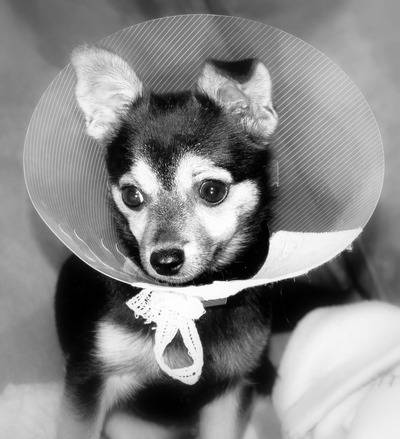

INSURANCE FOR STARTING A VETERINARY PRACTICE (OR OTHER BUSINESS)

7/14/2015

If you are starting a veterinary practice, medical practice, or other business, term life insurance is often required as collateral to get a small business loan. The lender may also require disability insurance.

Outlook Life helps medical professionals and businesses to get the life insurance and disability insurance they need to start their practices and businesses. We work with the SBA and other lenders so you can get on with your other tasks and know that we are taking care of this task. We have assisted veterinarians, dentists, doctors, DO’s, and all types of businessmen and women to fulfill their dreams of owning their own businesses.

What does this mean to you? It means that we know: 1) you are in a hurry; 2) you are very busy; and 3) you want someone to take over this task without taking advantage of you. What we will do for you is: 1) find you something fast; 2) keep it as simple as possible; 3) find you the lowest rate from scores of companies; AND 4) provide you with the forms and methods to make those policies meet your business loan requirements.

Call 866-866-0242 ext 914 today to get your instant, free life and/or disability insurance quotes so that you can start your veterinary practice, medical practice, dental practice, or small business. We are anxious to help you fulfill your dreams.

Cancer and Life Insurance

6/9/2015

No matter how mild, no matter how curable, the diagnosis of cancer prompts most people to think about life insurance.

No matter how mild, no matter how curable, the diagnosis of cancer almost always affects the patient’s ability to get life insurance.

This blog will address how to go about getting life insurance after being diagnosed with cancer. This is a very factual, step by step blog. But please know that my heart goes out to anyone in that position, and to your families and friends, and I pray that you find comfort in having this resource.

I. If you do not have any existing life insurance

A. Make sure you have checked with your work, your parents, your credit union, or other places where you might possibly have a policy. If you find one, also review section II.

B. Determine if you need it.

1. If you have lots of savings, few or no dependents, and are fairly debt free, you may not need life insurance at all. Keep in mind that you will have medical bills, may lose some work, and have other expenses associated with your treatment. But not everyone needs life insurance. It is your choice.

2. If you feel that even a small policy would be a big help to your family, go ahead and take what you can get.

a. Year One:

i. For the first year after diagnosis, the only kind you can get is usually Guaranteed Issue Life Insurance. It will not require an exam or medical records. You are going to think it is costly, and it will be graded. That means it will not pay 100% of the benefit until you have had it for 1-3 years. But that is all the more reason to get it now. You can always replace with a lower priced policy later on. Note: The maximum face amount you can get per policy is usually $25,000 during the first year after a diagnosis of cancer, but you can get more than one policy by going with different carriers.

b. Years One to Five:

i. After 1-5 years of being cancer free, you may be able to get Simplified Issue Life Insurance. This may be graded or it may pay 100% of the death benefit from day one. You might be able to get more than $25,000 in a single policy. Simplified life insurance will not require an exam, but could entail a phone interview and occasionally they order medical records.

ii. With some types and stages of cancer, you can get a medically underwritten policy at this time. A medically underwritten policy is one that requires an exam and medical records. You can usually get any amount of coverage that you can reasonably afford. Sometimes the carrier will add on a flat extra. This is a fee per thousand dollars of coverage that will stay on the policy for a set number of years, then drop off.

c. Five years after last cancer treatment:

i. Your chances of getting a medically underwritten policy without a flat extra, or simplified issue policy with moderate prices, are greatly improved after some years of being cancer free. You still should use an agency that specializes in impaired risk life insurance, as price ranges at this time can be clear across the board.

ii. When applying for medically underwritten life insurance, try to get a hold of pathology reports or the basics about your policy, to help your agent figure out which carrier to use. Have follow up tests done at the time of applying. Be ready to help track down medical records, if need be. Sometimes policies are declined for technicalities, but working hand in hand with a good agent can increase your chances of a good rate.

II. If you have existing life insurance

A. This is going to be the best priced policy you are going to have for a time, so do not let it lapse! It is easy to let life insurance premiums fall through the cracks with so much going on. You might want to put your policy on auto draft to avoid missing any payments.

B. If you have term insurance that is coming to the end of the term, contact your agent (or any other agent you trust) to assist you with it. You may be able to convert it to a permanent policy, rated the same preferred rating you had before you got cancer. Or you may be able to keep it in effect at a higher premium. Even term life often has options, so make sure you protect that valuable resource.

C. If you have permanent insurance, order a current illustration so that you know your policy is on track and will not lapse due to a loan or other reasons.

D. If you have life insurance through work, check to see if you can keep it even if you leave your job.

Please do not hesitate to reach out to me for advice if you or a loved one finds yourselves in this difficult situation. Anyone who has worked with me will tell you that sales are not my main focus … helping you have the resources you need is my main goal. If I can help you adjust or hang onto a policy have, that is what I will do. So please don’t be afraid to contact me. You’ve already survived a cancer diagnosis – getting life insurance is way, way less scary than that.